September 16, 2025

Guided by our belief that stronger ESG practices will ultimately lead to stronger performance, BCI uses our influence and shareholder rights to drive ESG improvements in our portfolio and across the broader capital markets.

Proxy voting is a crucial part of our stewardship activities. Share ownership comes with the right to vote at company meetings and participate in the decisions of the public companies that we are invested in. BCI takes this opportunity seriously and aims to vote at the meetings of every public company in our portfolio. We publish these votes ahead of each annual general meeting through a database on our website.

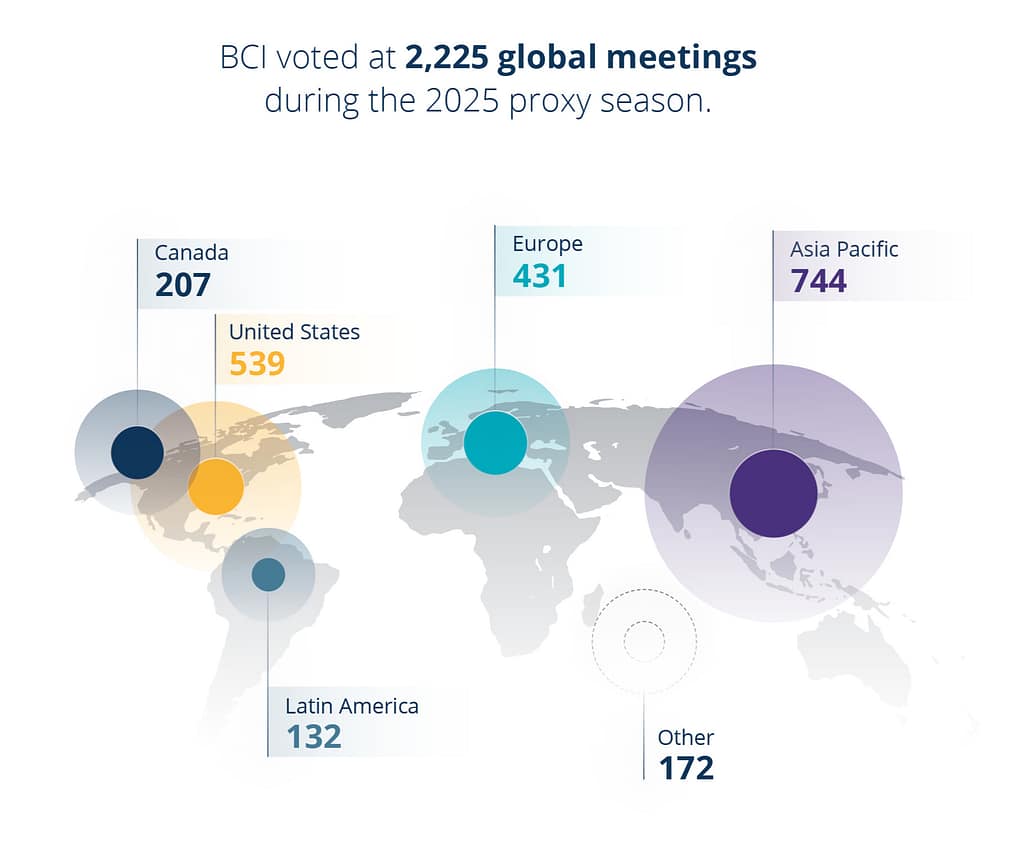

This voting season, spanning January to June 2025, was very active for BCI with 2,225 ballots cast globally, and we continue to see emerging trends in shareholder activity.

BCI season snapshot

2025 Proxy Season Summary |

|

|

Voted on 29,182 agenda items |

Voted against or withheld votes from 32% director nominees |

|

Voted in 52 countries |

Voted on 1,017 shareholder proposals |

|

Voted against management in 26% of cases |

Supported 48% of shareholder proposals |

Proxy season trends

The 2025 proxy voting season revealed significant shifts in shareholder initiatives, marking a departure from recent trends in both the volume and nature of proposals submitted to public companies.

Results from North American annual general meetings (AGMs) offer insight into this evolution. We have observed a sharp decline in the number of shareholder proposals filed, with a 26% decrease in volume compared to 2024 – one of the most significant declines in recent years. The reduction likely reflects the guidance provided by the Securities & Exchange Commission (SEC) early in the season, which allowed more companies to exclude proposals that had already been filed, and a potential recalibration of shareholder activism strategies. Other notable observations include:

- Focus on traditional corporate governance priorities: For the first time since 2021, governance-related initiatives outnumbered environmental and social (E&S) proposals. Governance proposals received strong investor support above 30%, reflecting continued emphasis on board composition, accountability, and shareholder rights.

- Headwinds for climate-related proposals: Average support for climate proposals dropped from 25% to 10%, signaling shifting investor sentiment and selectivity. However, in Canada, support for proposals asking banks to disclose the extent to which they are financing fossil fuels compared to cleaner energy sources via an “energy supply ratio” was markedly high with nearly 40% backing, bucking the downward trend. This suggests that investors are paying attention to financial institutions’ exposure to energy sector risks and opportunities.

- Challenges for diversity, equity and inclusion (DE&I) proposals: Support for DE&I proposals declined from 24% to 14%, with Equal Employment Opportunity-1 disclosure and racial equity audit proposals seeing increased backing, indicating higher investor appetite for transparency.

- Uncertainty about AI: Despite doubling in volume, support for AI proposals dropped from 17% to 10%, suggesting investor caution around this relatively new proposal topic and measures that could impact competitive positioning.

- Low support for anti-ESG requests: While we saw an increase in the number of proposals explicitly seeking rollbacks or an end to corporate activities addressing climate, DE&I, and other ESG topics, these proposals received consistently low support. With around 5% support, these proposals are unlikely to gain widespread favour.

We anticipate many of these trends will persist in future voting seasons, and expect to see continued strong support for governance-focused proposals and more nuanced investor expectations for environmental and social risk management.

BCI voting examples

- Climate Change: BCI supported proposals asking BMO, CIBC, and TD to disclose their renewable versus non-renewable energy funding ratios. TD achieved 38% support – a record for a climate proposal at a Canadian bank – with CIBC and BMO receiving 37% and 32% respectively.

- Governance: BCI cast ballots for over 12,000 director elections, voting against or withholding our vote for 32% based on poor governance practices with insufficient independence representing over half of the votes.

- Executive Compensation: BCI voted against UnitedHealth Group’s executive compensation plan due to a problematic $60 million front-loaded stock option award for the CEO. Forty percent of shareholders opposed the plan, demonstrating significant concern.

- Responsible AI: BCI supported a shareholder proposal asking Amazon to disclose how AI data center expansion affects its climate commitments. The proposal received 20% support, representing strong shareholder backing.

Looking ahead

Our work doesn’t stop at the ballot. After we vote, BCI directly follows up with select portfolio companies to ensure they understand our rationale and expectations. We also closely review our voting record to see how we made an impact and find areas to refine our approach. This review is an important step in preparing for any repeat shareholder proposals and will inform our biennial Proxy Voting Guideline update planned for 2027.

Proxy voting represents just one component of our comprehensive stewardship program, which also includes direct and collaborative engagement and policy advocacy work. As responsible stewards of our clients’ assets, this engaged approach is crucial to ensuring the long-term sustainability of our investments.

Learn more in our 2024-2025 Stewardship Report.

Sources: BCI, Institutional Shareholder Services, Morningstar, and RBC Capital Markets