By Lauren Bailey

PUBLISHED: August 22, 2025

As debate surrounding the role of sustainability in investment strategies intensifies, leading Canadian pension funds are demonstrating how active ownership is helping them fulfill their fiduciary duty, while building long-term resiliency into their portfolios.

During a recent discussion, Susan Golyak, director, environmental, social, and governance (ESG) at the British Columbia Investment Management Corp. (BCI) and Delaney Greig, director of investor stewardship at the University Pension Plan Ontario (UPP), outlined how active engagement, clear and consistent ESG integration, and proxy voting form the foundation of their funds’ sustainable investment frameworks.

Beyond divestment

While media headlines often focus on divestment, both Golyak and Greig stressed that divestment often can be the least effective tool in the sustainability toolbox.

As a jointly sponsored defined benefit pension plan, UPP’s mandate is to invest in the best financial interests of its pension plan members, delivering secure, long-term retirement outcomes for its participants across Ontario’s university sector, said Greig. She noted that the $10B (C$12.8B) plan was designed, from its inception four years ago, with active ownership as a central pillar. While investment exclusion is a tool the fund can use to deal with industry or company-specific risk, she said there’s a much broader set of active ownership tools it relies on more heavily. Those tools include incorporating manager selection due diligence and ongoing monitoring, as well as direct engagement with companies, proxy voting, and policy advocacy on broader, systemic issues.

“When we’re using those tools, we’re looking at things that . . . will affect the portfolio as a whole, like climate change and inequality that . . . play out on our diversified portfolio across our exposures. They’re not specific to whether one company is going to succeed or fail, [but more] about whether the entire portfolio or, in some cases, the entire economy, is going to [fail].”

Golyak echoed this sentiment, noting BCI’s mandate is to invest its $212B (C$295B) assets under management in the best financial interests of its pension and corporate clients in the province. Together, its clients represent more than 725,000 beneficiaries, so protecting their financial interests is a top priority for the pension fund, she said.

She noted broad-based divestment doesn’t serve that mandate, noting the fund isn’t interested in making decisions that exclude parts of the investment universe.

“Our portfolio managers make decisions on a day-to-day basis in terms of adding and removing names from the portfolios for various reasons. But when it comes to broad-based divestment of companies, for example, those are decisions that we don’t believe are in the best interests [of our fiduciaries]. We think it’s much more important to maintain our ownership and engage with the company.”

Like UPP, BCI uses many tactics to exercise its influence, but its core strategy is direct engagement with companies on material issues through collaboration with [peers] and other members of groups like Climate Action 100 and Climate Engagement Canada.

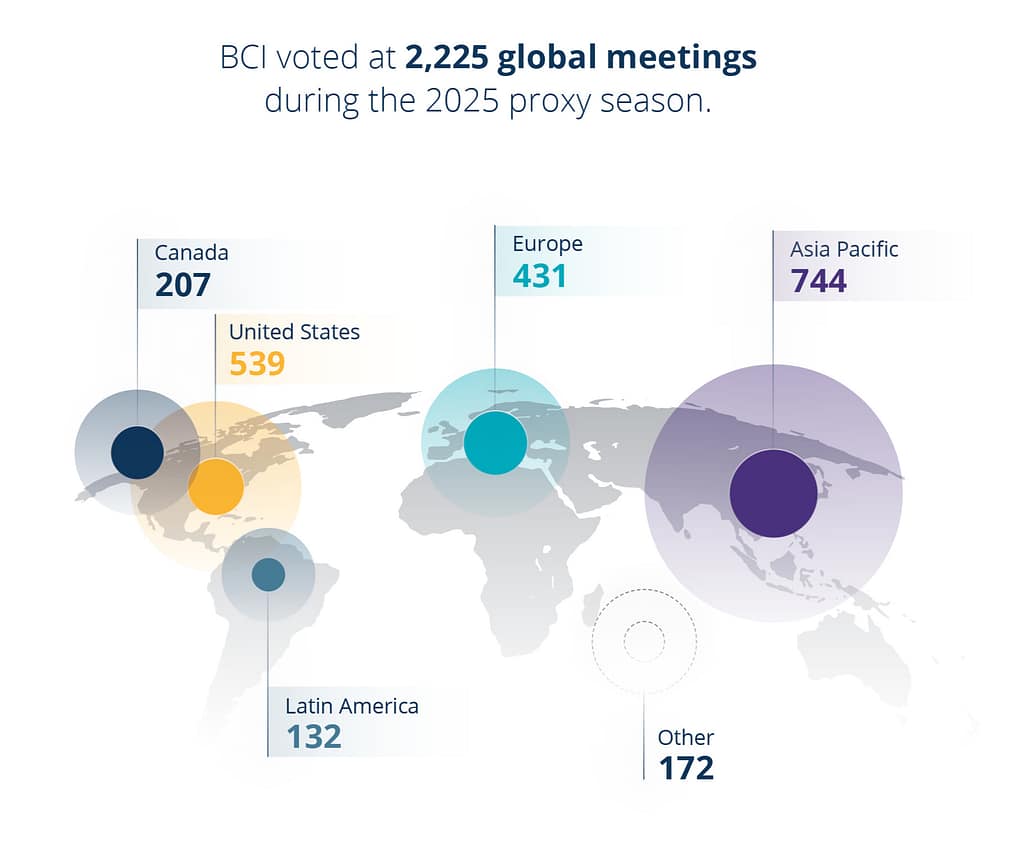

While the pension fund has some exclusions based on federal government treaties, executing its votes through proxy-voting mechanisms is a major part of its stewardship activities. But from an overall risk management perspective, the investment teams integrate ESG considerations into every aspect of the investment process to ensure they’re mitigating risks associated with ESG factors and capturing opportunities, she shared.

Harnessing the shareholder “voice”

When used effectively, shareholder proposals can influence corporate behavior and safeguard returns in a market where ESG issues are increasingly viewed as financially material.

“We believe ESG factors do make a difference to long-term returns,” said Golyak, noting that governance expectations form a large share of BCI’s voting activity.

She said BCI has tightened its approach to shareholder proposals and proxy voting, issuing updated guidelines every two years to reflect shifting governance trends and evolving ESG concerns. The pension investment manager publishes a public version of its guidelines on a bi-annual basis, after consulting clients on potential revisions. The guidelines provide companies with a roadmap of how BCI is likely to vote and what practices it expects to see from corporate boards. BCI’s clients delegate the final authority on votes, and it is expected to make all decisions with their long-term financial interests in mind.

The guidelines also link directly to BCI’s broader engagement priorities, aligning position statements, expectations, and voting actions to push companies toward improved practices. She added that beneficiaries often scrutinize the fund’s voting record and increasingly expect managers to hold corporate leadership accountable while supporting credible shareholder initiatives.

“The ESG team creates the guidelines, executes the votes, and manages the relationship with the proxy voting service provider that facilitates the process,” said Golyak. “That accountability and mandate rests with us.”

Internal portfolio managers are kept informed and engaged in discussions about upcoming votes, she said, noting collaboration with the investment team ensures alignment between proxy-voting decisions and the fund’s long-term sustainability objectives.

UPP also leverages proxy voting as a direct tool to influence corporate behavior in ways that support positive outcomes for the fund and its members.

The pension fund recently moved more of its proxy voting in-house, seeking greater consistency across its portfolio and closer alignment with beneficiaries’ long-term interests. Greig noted the pension investment manager has also been transitioning assets from pooled funds to segregated mandates, where possible, to “hold the pen” on proxy votes and ensure a unified approach to corporate governance across the portfolio.

“Our only reason for voting is the long-term vested interest of our clients, as opposed to a manager who has multiple clients with different priorities,” Greig pointed out.

When it comes to executing a vote, the fund considers portfolio-wide standards for governance, including expectations for board independence and auditor rotation. She said UPP votes with the broader market view in mind, favoring governance practices that have proven effective over time.

While proxy advisory firms often draw scrutiny, Greig emphasized that these firms serve more as research providers than decision-makers. UPP relies on an external proxy research platform to handle the vast scale of global voting.

“We vote across thousands of companies worldwide. We don’t have the time to sift through every disclosure ourselves — that’s where the external provider comes in.”

The firm screens corporate disclosures against those guidelines and supplies relevant information, enabling the fund’s stewardship team to execute the votes. “In some senses, the term ‘advisory’ is a misnomer,” she added. “For us, they are a proxy research firm. They don’t decide how we vote — we do.”

Transparency, communication key

Proxy voting can be seen as a blunt instrument, so clear communication and transparency surrounding reasons a firm is casting its ballot in any direction is critical.

“When we vote against a director or executive pay, we make a point of telling companies why,” said Greig. “Otherwise, they may not understand if it’s about governance, diversity, compensation, or another issue entirely.”

One of the multiple channels UPP uses to increase transparency is a real-time, proxy-voting disclosure site that is updated as soon as votes are cast — sometimes even before annual general meetings. It also aggregates votes and rationales in its quarterly reports for easy access and sends direct letters to companies— particularly where engagement is ongoing or exposure is high — explaining the rationale for votes against management and requesting that their boards be made aware.

The goal, she said, is to ensure companies understand the rationale underlying UPP’s votes. For instance, a vote against the chair of a nominations committee may stem from concerns about board diversity or board independence. Communicating the specific reasons demystifies the blunt instrument of a “yes” or “no” vote.

Beneficiaries are another key audience. Making proxy policies, rationales for votes against management, and explanations for shareholder proposal decisions not only keeps beneficiaries informed but also allows them to hold the fund accountable, said Greig.

As well, external stakeholders, including advocacy groups, may review and critique UPP’s voting record, she continued. “At the end of the day, it’s our policy and our analysis of long-term interests that determine how we vote. But it’s important to understand what other stakeholders are thinking as well.”

Golyak agreed, noting BCI is comfortable providing regulators with either aggregated data or specific examples, showing how expectations are embedded in actual votes. “When regulators can review investors’ guidelines and see who plans to vote against directors — and why — that’s a compelling demonstration of our seriousness.”

Republished with permission. Read the original article on Markets Group.