Investing in Infrastructure & Renewable Resources

Victoria, British Columbia – British Columbia Investment Management Corporation (BCI) has been selected for the first time as one of Canada’s Top Employers for Young People. The recognition is part of Canada’s Top 100 Employers produced by Mediacorp Canada Inc., which has named BCI one of Canada’s Top 100 Employers for the last six years.

“I’m excited BCI is recognized as a top employer for young people,”

said Norine Hale, BCI’s Executive Vice President, Human Resources.

“This recognition reflects our commitment to fostering an inclusive and supportive work environment where young professionals can build their expertise, bring innovative ideas to the table, and make a difference through purposeful work.”

As BCI continues to drive sustainable growth on a global scale, investing in the next generation of world-class professionals is essential. Over the years, BCI has expanded its co-op and intern program, hiring students and recent graduates from across the country year-round. In 2024, 175 co-op students and interns completed 227 work terms across the organization. The program provides hands-on work experience alongside opportunities to build connections and learn new skills. Since the program’s inception, over 136 co-op students and interns have transitioned into full-time roles.

In addition to the co-op and intern program, BCI offers various development and leadership opportunities to help young employees build their professional skills, networks, and confidence. BCI offers a mentoring program, subsidies for professional accreditations and development, and a wealth of training opportunities to help early-career professionals discover their passions and hone their skills.

To read BCI’s top employer profile, visit Canada’s Top 100 Employers website and check out the special feature published by The Globe and Mail. To learn more about work at BCI visit our Careers page.

Mediacorp Canada Inc. is the nation’s largest publisher of employment periodicals, reaching millions of Canadians each year. The editors evaluate applicants for Canada’s Top Employers for Young People based on the programs, benefits, and opportunities they offer to attract and retain young workers.

Artificial Intelligence (AI) is revolutionizing the way we work across sectors and industries around the globe. From increasing operational efficiency to improving decision-making, these unprecedented advancements can translate into business results and more meaningful work – but only if you’re comfortable with being uncomfortable.

Tony Payne, BCI’s Senior Vice President, Technology & Innovation and Chief Technology Officer shares how BCI is harnessing the power of AI to create efficiencies and why being nimble and resilient to change is essential for global investors.

Q1: You have led technology teams for more than two decades. What’s your current philosophy around innovation?

TP: Innovation is not just a thing that happens; it’s a process that supports human aspirations. I believe there is always room for improvement, efficiency gains, and challenging the status quo. If you stop paddling, you will float downstream. To see what is around the corner and explore new horizons, you need to press forward, seek opportunities, and generate excitement on the journey.

That’s the approach we take at BCI. It’s not always easy, but we are laser focused on delivering for our clients and that means building a culture where we can constantly evolve. The willingness of our people to embrace innovation as a process and seek different ways of doing things makes it easier to bring new ideas to life.

Q2: When you look at the AI landscape, what’s top of mind?

TP: Digital transformation and disruption are in the DNA of technologists. What’s most exciting for me right now is the pace at which AI is evolving and creating new opportunities. Not so long ago, the smartphone revolutionized personal computing by combining multiple devices and functions into one – going beyond just traditional phone, music, and camera capabilities to become our go-to for things like banking and health data. The proliferation of AI alongside robotics will generate a whole new world of possibilities, enabling people to truly do things differently.

As AI continues to be embraced by mainstream users, the focus is shifting to how we can add value and tackle challenging thought-work, while leaving mundane tasks to AI-enabled tools. This is pushing people to step out of their comfort zone and re-imagine their roles in a modern world.

Q3: BCI was an early adopter of AI. How is that changing the way you deliver for our clients?

TP: When embraced, technology is a critical enabler that can help BCI operate more efficiently and open new operational and investment approaches. We see AI as a key capability, tool, and facilitator, and actively look for ways to integrate it into our work. From automating basic administrative tasks to assisting our investment teams with advanced data analysis using natural language processing, AI is at the forefront of the tools we leverage. It’s freeing up more time to do the work that generates the returns our clients depend on.

BCI was one of 10 companies in Canada chosen by Microsoft to participate in its Early Access Program for Copilot and Azure, two groundbreaking generative AI-integrated tools. Of BCI’s 300 initial Copilot users, 84 per cent reported a 10 to 20 per cent increase in productivity while 76 per cent of users said they would not be willing to go back to working without it. Importantly, our participation gave us the opportunity to provide feedback and influence the development of these tools.

Q4: As a leading global investor, what drives you to stay ahead of emerging technologies?

TP: With a portfolio of more than $250 billion in assets under management, our ability to leverage technology to create value is central to our competitive advantage. Across our portfolio, we analyze massive amounts of data to support new and existing investments. Carefully factoring AI into our investment process allows us to derive better insights from available data and create process efficiencies, leading to faster and better decisions. At our current size, even incremental improvements can translate into business wins that ultimately benefit our clients and the communities they serve.

Strong partnerships between BCI’s technology and investment teams are at the core of our approach, and together we focus on the highest impact opportunities and create fit-for-purpose solutions. For example, ESG is deeply integrated into our investment processes across asset classes, and we actively use AI to improve the coverage and quality of sustainability data for our portfolio managers. We are also collaborating to look at how AI can support the development of net-zero roadmaps for our private equity and infrastructure portfolio companies.

Q5: What advice do you share with employees and partners about navigating the ambiguity of AI?

TP: Both new technology and technological disruption change everything, but there is no silver bullet to fix complex things. AI is currently going through a hype-cycle and, in the process, there will be wins and losses. We have to stay resilient, embrace change, and look for opportunities – big and small.

That means taking calculated risks and not being afraid to learn from failure. BCI has guiding principles that act as guardrails and allow us to accelerate AI use in a measured way that aligns with our risk tolerance. In this new landscape, navigation really comes down to each of us feeling empowered by new technologies and getting comfortable with being uncomfortable.

Learn more about how BCI is enhancing productivity through generative AI.

Norine Hale, Executive Vice President of Human Resources, reflects on how BCI’s commitment to people and culture has contributed to being named one of Canada’s Top 100 Employers six years in a row.

Q1: Strong values alignment between an organization and its employees is a hallmark trait of a top employer. What drives BCI employees’ passion and commitment to living BCI’s values?

NH: I believe that our employees take the BCI value of Clients First very seriously. Most of the assets we manage are for pension funds that count more than 740,000 British Columbians as their beneficiaries. Our employees’ work contributes to paying pensions for retirees’ who spent lengthy careers as police officers, bus drivers, nurses, or teachers. Honestly, I can get a little emotional when I think about that and how important it is to safeguard and grow the investment funds to support these pensions. Our people are committed to Clients First and live BCI’s additional values, knowing their day-to-day decisions will impact these individuals, their families, and their communities. We take pride in our performance for both pension and non-pension clients, recognizing it as a powerful instrument for positive change and the greater good.

Q2: Top employers are known for constant improvement. What approach does BCI take to growth and development?

NH: BCI is a hub of exceptional and diverse individuals ready to share their knowledge and expertise. We prioritize learning and development through various programs and initiatives such as tuition reimbursement and in-house training, as well as establishing career pathing to ensure clear avenues for our employees to grow their careers with BCI.

Our co-op program provides hands-on work experience for people just starting their careers. It’s been an incredible talent pipeline and an opportunity for our employees to share and refine their knowledge through training post-secondary students and recent graduates.

We also encourage informal learning through mentorship, lunch and learns, and knowledge-sharing initiatives like our investment and public speaking clubs. People are willing to share what they know, making knowledge exchange probably the greatest source of learning here at BCI. Employees are encouraged to take the time for valuable informal discussions, and coffee chats are a key part of our culture. We really try to inspire curiosity, and I think employees know that. The people who are successful at BCI are curious. They’re the ones asking questions, listening and learning from each other.

Q3: Curiosity and innovation usually go hand in hand. Can you share how BCI fosters innovation?

NH: Innovation is one of the three strategic ambitions we established in our current business plan, and we are proud to encourage employees to be creative and support their efforts to innovate. This year we created an innovation council and ran an internal event called ‘The Innovation Bull Pen’ where employees pitched their ideas. We were also one of just 10 Canadian companies that participated in the Early Access Program for Microsoft Co-pilot and became early adopters of this AI tool. At our last town hall, we brought in an amazing speaker to inspire our employees and reinforce that innovation isn’t limited to technology. Innovation is about developing fresh ideas and approaches – it’s a mindset.

Since joining BCI more than 10 years ago, our CEO/CIO, Gordon J. Fyfe, has emphasized the importance of innovation and led by example. He took BCI from a ‘plain vanilla’ investment manager to an active, global investment manager that has a well-diversified lineup of investment strategies. So, while innovation with “capital letters” is new this year as part of our latest business plan, we have been at this for a while. I’ll add that “small i” innovation is essential too. Innovators aren’t just those coming up with the big ideas, innovation also occurs when people find incremental improvements in their day-to-day work. While these may seem small, these improvements can have exponential impacts. Being innovative is a journey without a final destination, and we’re continuing on this road to ensure we can maintain our commitment to deliver for our clients.

Ten of Canada’s largest pension investors and investment managers, representing more than $2.25 trillion in assets under management, today affirm their support for both the Canadian Sustainability Disclosure Standards (CSDS) from the Canadian Sustainability Standards Board (CSSB): General Requirements for Disclosure of Sustainability-related Financial Information (CSDS 1) and Climate-related Disclosures (CSDS 2), collectively the CSSB Standards.

The CSSB standards establish a robust framework for the Canadian market, while addressing specific Canadian circumstances. Alignment with a global baseline is important for the competitiveness of Canadian companies in global capital markets and for Canadian directors to discharge their duties to the companies they oversee. We also believe that this will reduce the reporting burden for Canadian entities that operate or raise capital in multiple jurisdictions.

For major institutional investors, complete, comparable sustainability-related information is a key part of making informed investment decisions. The CSSB’s standards address both general sustainability-related disclosures and climate-specific requirements, thus providing a framework to access this critical information.

While we recognize the need to make modifications to address Canadian-specific considerations, we encourage Canadian issuers to not delay the measurement and reporting of material sustainability-related information, particularly where “reasonable and supportable information is available to the entity at the reporting date without undue cost or effort.” For effective capital allocation decisions, investors depend on standardized disclosure across the full spectrum of material sustainability risks and opportunities.

As part of our mandates, our objectives are to deliver long-term, risk-adjusted returns that help support retirement and benefit security for millions of Canadians. We believe these standards will strengthen the Canadian market’s sustainability disclosure infrastructure and improve the quality of information available to investors, stakeholders and regulators. We call on corporate leaders to adopt CSDS 1 and CSDS 2 to ensure the transparency and comparability needed to make investment decisions that will contribute to a more prosperous future for our clients and beneficiaries.

ABOUT:

British Columbia Investment Management Corporation (BCI)

Gross AUM $250.4 billion (as at March 31, 2024)

About

Media: Olga Petrycki, Tel: +1 778 410 7310, Email: media@bci.ca

CDPQ (Caisse de dépôt et placement du Québec)

AUM $452.0 billion (as at June 30, 2024)

About

Media: Media Relations team, Tel. : + 1 514 847 5493, Email: medias@cdpq.com

Canada Pension Plan Investment Board (CPPIB)

AUM $675.1 billion (as at September 30, 2024)

About

Media: Frank Switzer, Tel: +1 (416) 523 8039, Email: fswitzer@cppib.com

Healthcare of Ontario Pension Plan (HOOPP)

AUM $112.6 billion (as at December 31, 2023)

About

Media: Scott White, Email: swhite2@hoopp.com

Investment Management Corporation of Ontario (IMCO)

AUM $77.4 billion (as at December 31, 2023)

About

Media: Neil Murphy, Tel: +1 (416) 898 3917, Email: neil.murphy@imcoinvest.com

Ontario Municipal Employees Retirement System (OMERS)

AUM $133.6 billion (as at June 30, 2024)

About

Media: Don Peat, Tel: +1 (416) 815 4433, Email: media@omers.com

Ontario Teachers’ Pension Plan (OTPP)

AUM $255.8 billion (as at June 30, 2024)

About

Media: Dan Madge, Tel: +1 (416) 419 1437, Email: media@otpp.com

OPSEU Pension Plan Trust Fund (OPTrust)

AUM $25.0 billion (as at December 31, 2023)

About

Media: Jason White, Tel. : +1 (416) 201 1527, Email: jwhite@optrust.com

Public Sector Pension Investment Board (PSP Investments)

AUM $264.9 billion (as at March 31, 2024)

About

Media: Maria Constantinescu, Tel: +1 (514) 218 3795, Email: media@investpsp.ca

University Pension Plan (UPP)

AUM $11.7 billion (as at December 31, 2023)

About

Media: Zandra Alexander, Tel: +1 (647) 454 2612, Email: media@universitypensionplan.ca

BCI is pleased to announce the reappointment of Paul Finch to the Board of Directors.

The Public Service Pension Plan Board of Trustees has reappointed Paul for a three-year term from April 1, 2025 through March 31, 2028.

Paul was first appointed to the Board by the Public Service Pension Plan Board of Trustees on April 1, 2019. He is a member of the Human Resources and Governance Committee.

Paul is president of the BC General Employee’s Union (BCGEU), a plan partner representative for the Public Service Pension Plan and the College Pension Plan, a trustee on the Public Service Pension Plan Board of Trustees, chairperson of the BC Target Benefit Pension Plan, and.

He also serves on the National Executive Board of the National Union of Public and General Employees and the Executive Council of the BC Federation of Labour.

Paul completed the Directors Education Program at the University of Toronto’s Rotman School of Management in 2019 and holds the ICD.D designation from the Institute of Corporate Directors.

BCI’s Board is structured in accordance with the Public Sector Pension Plans Act. Of the seven-member Board, the four largest pension plan clients each appoint a member from their board of trustees, and the Minister of Finance appoints the other three — two of which must be representatives of clients.

Learn more about BCI’s Board of Directors.

By: Zak Bentley

PUBLISHED: 25 November, 2024

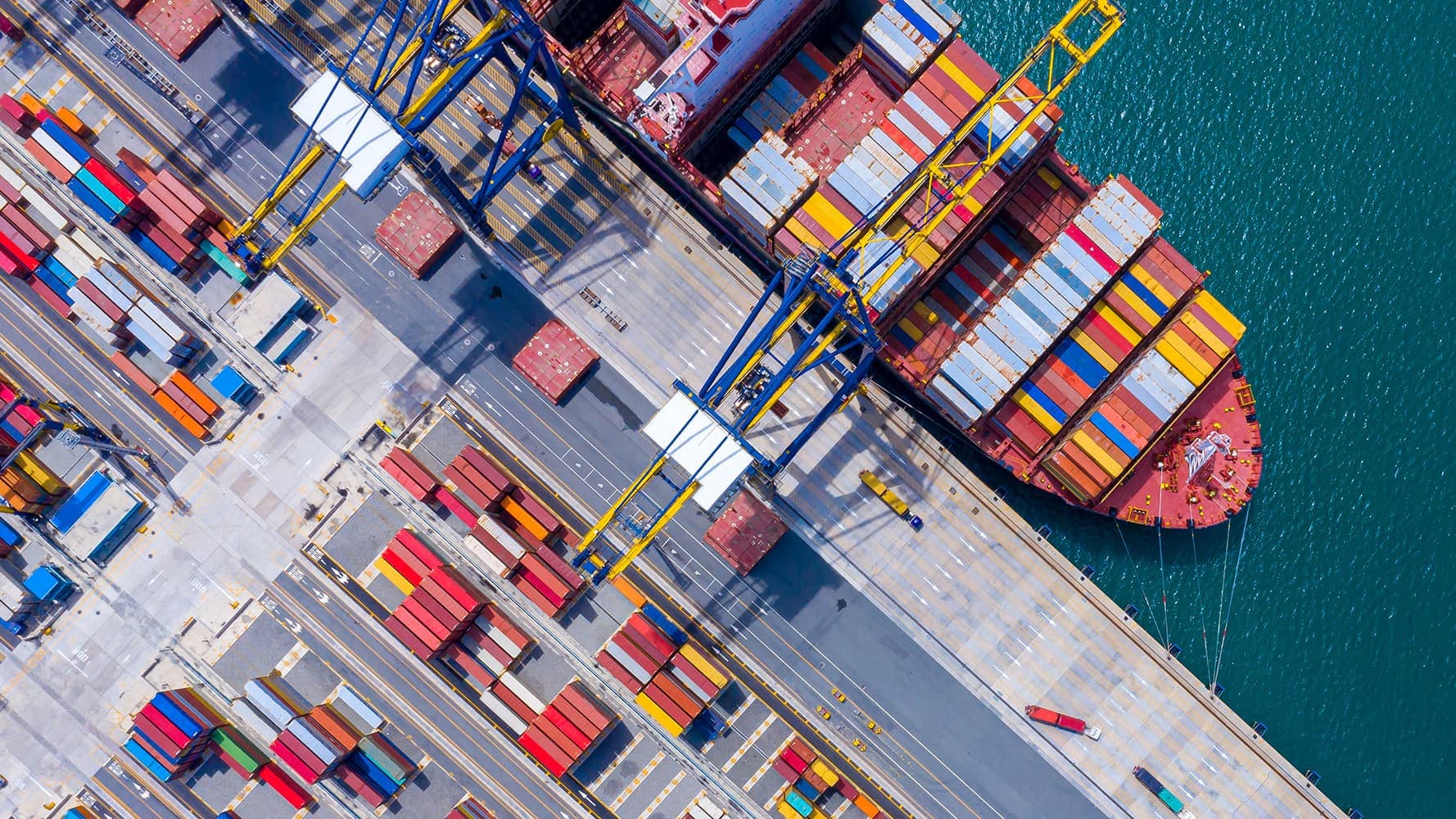

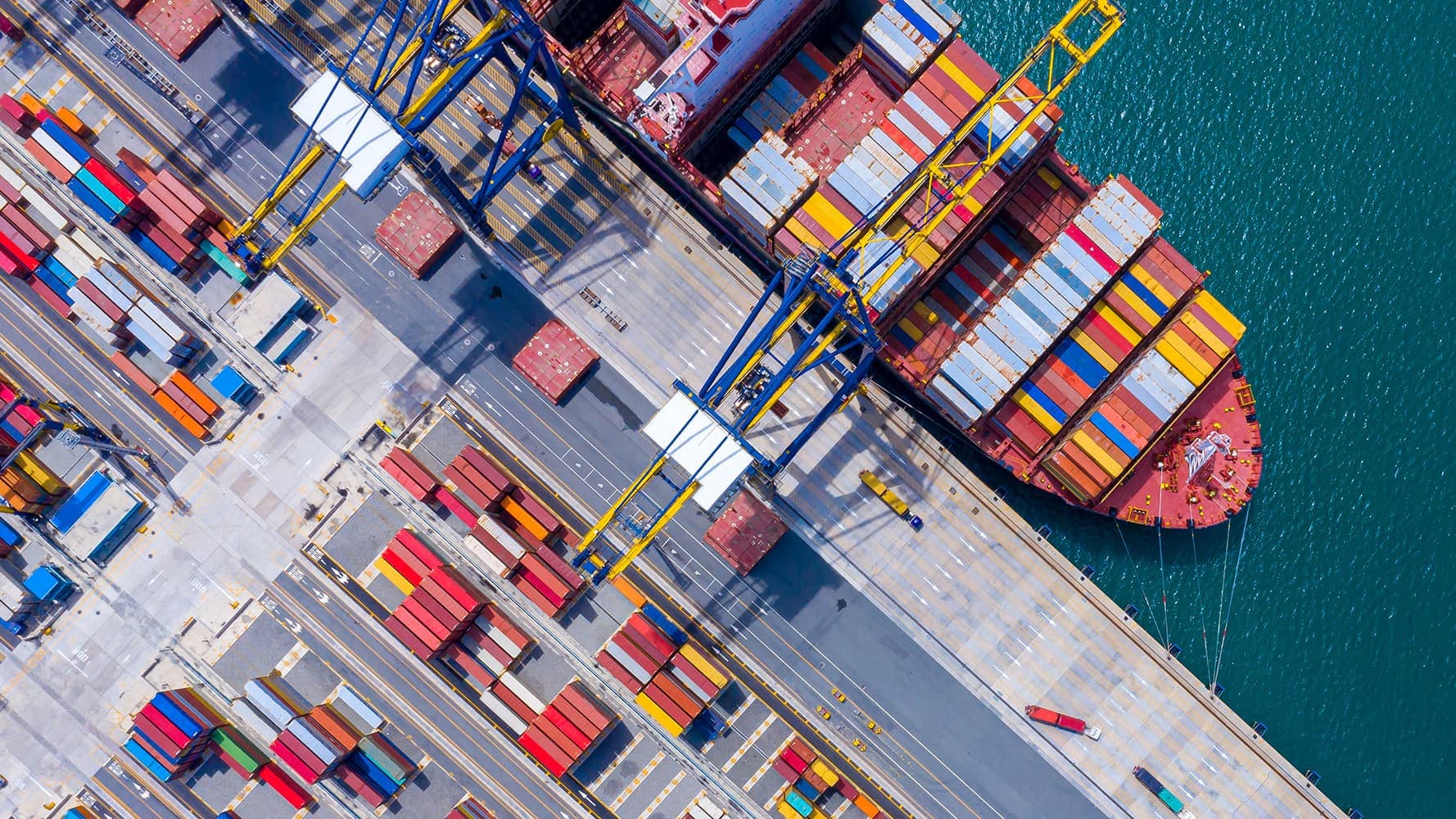

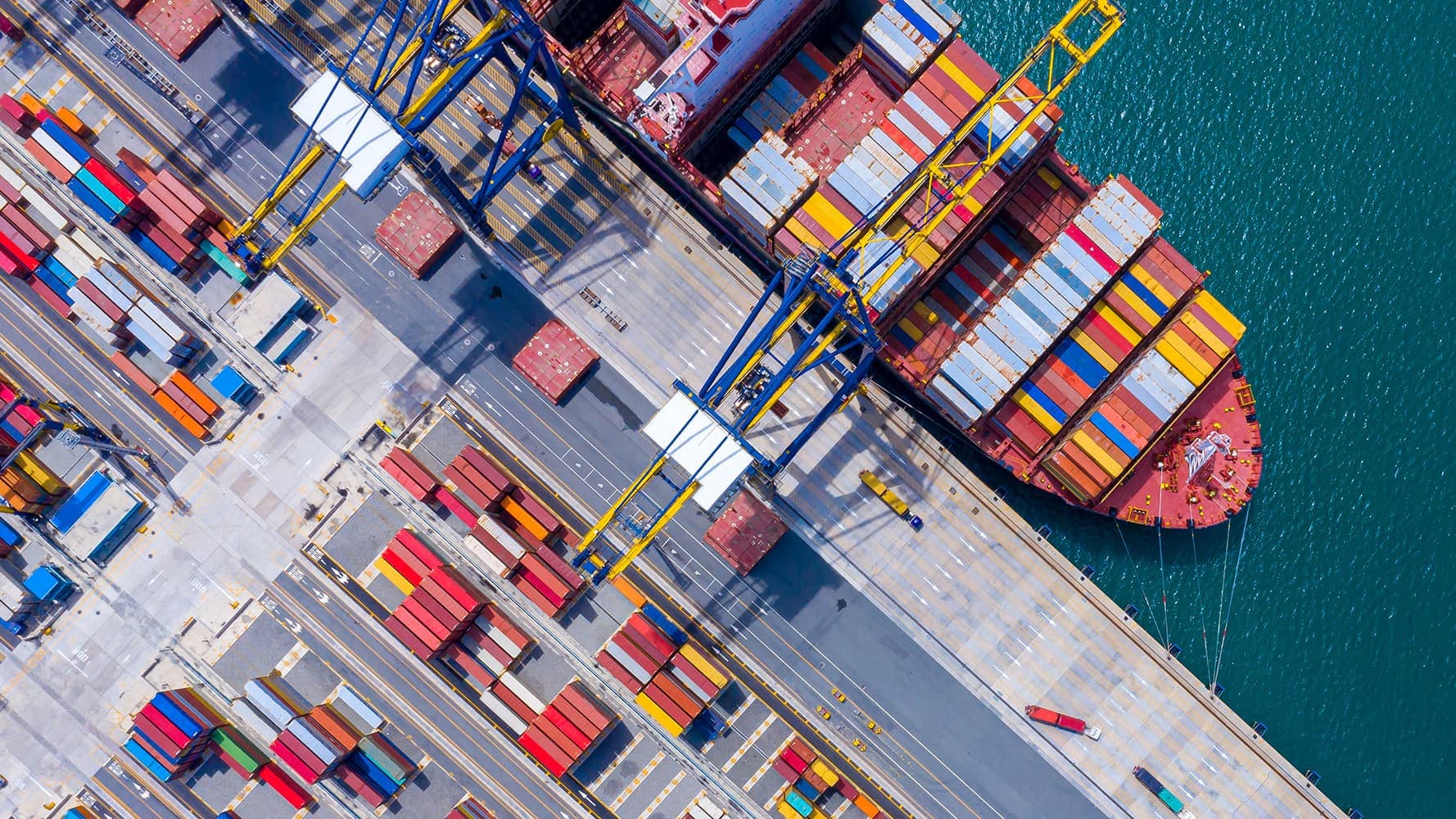

British Columbia Investment Management’s head of infrastructure Lincoln Webb tells us ‘there’s a lot of runway to invest’.

British Columbia Investment Management is planning to increase its infrastructure assets under management by 60 percent by 2030, according to Lincoln Webb, the group’s global head of infrastructure and renewable resource investments.

The Canadian institution currently has C$28.1 billion ($20 billion; €18.9 billion) of AUM in its infrastructure and renewable resources programme, as at the end of March 2024, accounting for 12.3 percent of BCI’s total AUM. However, the manager of 29 British Columbian public sector clients is eyeing significant growth.

“[Our clients] are universally under-allocated to the space versus their long-term goals. On average, infrastructure represents 12 percent of our total assets at BCI and most of our clients are seeking to advance to a 15-25 percent allocation,”

Webb told Infrastructure Investor. “When we think about that over the coming years, we expect the programme to go to C$45 billion by 2030, so that leaves significant investment runway. After we reach full allocation, we then of course will evaluate clients’ appetites to invest further in the space.”

BCI delivered a 7.9 percent return for the infrastructure and renewables programme for 2023-24, ending in March. That was slightly down on the 9.2 posted the previous year, although the portfolio is exhibiting an 8.5 percent five-year return and 9.2 percent over the last 10 years.

This, Webb says, reflects the core infrastructure make-up of the portfolio, including assets such as UK gas distribution system National Gas, US utility Puget Sound Energy and Chilean transmission company Transelec. It also has an 8.7 percent ownership in the beleaguered Thames Water, having invested in 2006, which BCI declined to comment on.

In contrast to several core-oriented infrastructure investors, Webb said that the group hasn’t suffered particular deployment struggles in the past 18 months.

“We try to be thoughtful about the future of the program – ensuring we are an active participant in the market. Especially right now, for example, where, although there are not necessarily bargains, it is still a very interesting market from a buyer’s perspective,” he maintained. “Whether it’s renewables, transportation or other sectors, the supply-demand balance appears relatively attractive.”

Webb added: “We’re finding when we are getting into auction processes, they’re less aggressive. It doesn’t mean they’re not competitive, but the number of serious bidders has come down to a more manageable level, something that we think is more reasonable. We have also found a lot more openness to dialogue – whether it’s with corporates or sellers of assets around more bespoke transactions or more creative structures that we just were not seeing two or three years ago.”

One example, according to Webb, was a deal announced in August in Japan whereby BCI joined forces with Macquarie Asset Management for a sale and leaseback of a portion of its mobile network assets, worth between $1 billion and $2 billion, with Rakuten to continue to manage the assets.

“We found a solution for Rakuten that allowed them to unlock capital to reinvest in other facets of their business and allowed us to invest in their network,” Webb explained. “That’s an example where we can have a deeper dialogue with a market player around meeting their needs and at the same time opening investment opportunities for ourselves.”

Strategic fit

Rakuten, of course, is not BCI’s only asset held alongside Macquarie. The aforementioned National Grid and Puget Sound Energy are also in the partnership, as well as Australian electricity network operator Endeavour Energy, France-based Reden Solar and battery storage platform Eku Energy.

“It’s not that our portfolio is all core assets, but the alignment around our interest in that area of the market has led to a historical relationship with Macquarie,” said Webb, while noting that the two have a relationship going back to when BCI first invested in the asset class in 2006.

“With Brookfield, we’ve collaborated on a number of successful investments in emerging markets,” he added.

The relationship with both GPs also extends to fund commitments, with BCI a serial investor in funds managed by the duo across geographies and risk profiles. While about 83 percent of BCI’s infrastructure investments are made directly, it reserves the remainder for fund commitments, which have also included GPs such as Actis, KKR and ArcLight.

“[Fund commitments] can provide access to markets where we don’t have a strong presence or sectors that we’re not as strong in and not seeing the full scope of opportunities we would like to. I would say the key theme, however, is the long-term strategic nature of these relationships, which have been helpful in allowing us to execute our global direct investment model,” Webb reasoned.

Somewhat unusually, about a quarter of BCI’s infrastructure portfolio is in emerging markets. It teamed up with Brookfield and GIC in September to acquire American Tower’s operations in India for about $2.2 billion, while also in India in 2023 invested $300 million into the I Squared Capital-backed toll road platform Cube Highways Trust.

“What allows us to do that is having a strong developed market, core foundation in the programme. In seeking higher returns with higher risk in emerging markets, we can build on and complement this more conservative core foundation,” says Webb.

“When we think about investing in markets such as Brazil, Colombia and India, we are very selective and spend quite a bit of time in these markets before we invest. We were just in the Philippines, for example, undertaking due diligence work as a future market for our program. Overall, we try our best to be very disciplined in identifying high quality companies and partners in these growth economies.”

New ground

In more developed markets, BCI opened its new office in London in June 2023, with a view to making more investments in the UK and Europe. Its first investment from the office was a €300 million commitment to the A2 motorway in Poland owned by Meridiam.

BCI has also expanded the programme in the last 18 to 24 months to include infrastructure debt investments, which have included loans to the data centre platform EdgeConnex and fibre company GlobalConnect, both owned by EQT Infrastructure and two sub-sectors not covered by its equity strategy to date.

“The market is very focused in the digital space as the need for capital is high. When we look at the opportunity set, we feel today there are very good opportunities further up the capital stack of these companies and assets,” Webb outlined. “We still look at equity investments in data centres, towers and fibre, but when we consider the growth that investors need to underwrite to and where valuations are today, we find the risk-return profile stronger in the debt rather than the equity.”

Spoken like a true core infrastructure investor.

Republished with permission. Read the original article on Infrastructure Investor

BCI was recently featured in Microsoft’s customer story series highlighting our adoption of generative AI tools, Microsoft 365 Copilot and Azure. Our successful global implementation of these tools has resulted in 22 solutions that have streamlined operational processes, reduced manual and repetitive tasks, and saved over 2,300 human hours.

Embracing technology like generative AI is key to delivering on our priority of accelerating innovation as one of Canada’s largest institutional investors. BCI was one of only 10 companies in Canada chosen to participate in Microsoft’s Early Access Program for Copilot and one of two organizations across the Americas to be highlighted for our successful adoption.

Hear from BCI’s technology team about our AI-powered productivity gains and how technology is empowering us to focus on what matters most: generating returns for our clients.

On November 4, 2024, BCE Inc. announced that its wholly-owned subsidiary, Bell Canada (“Bell”), has signed a definitive agreement to acquire 100 per cent of Ziply Fiber (Ziply) – a BCI private equity program investment. Ziply is the largest, regionally-focused fibre internet provider in the U.S. Pacific Northwest, with operations and assets in Washington, Oregon, Idaho, and Montana.

This marks Bell’s first expansion outside of Canada, and will accelerate their fibre growth strategy across North America. Ziply is currently owned by an investor consortium led by Searchlight Capital Partners, including BCI, and the sale to Bell was supported by a unanimous vote. The agreement values Ziply at approximately C$7.0 billion, with the accepted offer consisting of approximately C$5.0 billion in cash, and the assumption of C$2.0 billion of outstanding net debt rolled over at the transaction close.

“The sale and valuation of Ziply underscores the quality of the fibre network our investor consortium created when we originally acquired the fibre network assets and rebranded the business Ziply in 2020. Alongside other investors, BCI’s private equity program is exceptionally proud of the growth Ziply has already demonstrated and the reputation they have built in the past four years,” said Jim Pittman, EVP & Global Head, BCI Private Equity. “Today, demand for fibre optic services remains very high, and we’re excited for the opportunity ahead for a known Canadian brand like Bell to leverage these core assets as they pursue their new U.S. expansion strategy. Our team continues to see opportunities in the fibre optic space and will continue to evaluate new opportunities in the sector.”

Stands firm on ESG and climate engagement to achieve real-world outcomes

Victoria, B.C. – October 8, 2024 – British Columbia Investment Management Corporation (BCI) today published its 2023-2024 Stewardship Report, demonstrating continued leadership in driving positive environmental, social, and governance (ESG) performance and generating long-term sustainable value through global policy advocacy, proxy voting, and engagement.

“BCI’s inaugural stewardship report builds on more than two decades of responsible investing,” says Gordon J. Fyfe, BCI’s Chief Executive Officer and Chief Investment Officer. “Active ownership is critical to delivering the returns our clients depend on, both through the management of risks associated with responsible investing and by capturing sustainability-related opportunities.”

This inaugural report furthers BCI’s annual ESG and climate-related disclosures, which are moving towards alignment with the globally recognized IFRS Sustainability Disclosure Standards, and provides an in-depth look at how BCI leverages its influence as one of Canada’s largest asset managers to drive continuous improvement with our portfolio companies.

“The challenges we face require action from all parties. As a global investor, we play a role in creating a resilient and productive investment environment for generations,” says Jennifer Coulson, BCI’s Senior Managing Director & Global Head of ESG. “While there is significant work ahead, the progress we are seeing from companies and policymakers alike reinforces our belief that multifaceted engagement can drive real-world outcomes.”

Highlights:

BCI’s annual ESG and climate-related disclosures are published in our 2023-2024 Corporate Annual Report.

Read the 2023-2024 Stewardship Report on BCI.ca.

ABOUT BCI

British Columbia Investment Management Corporation (BCI) is amongst the largest institutional investors in Canada, with C$250.4 billion in gross assets under management as of March 31, 2024. Based in Victoria, British Columbia, with offices in Vancouver, New York, and London, U.K., BCI manages a portfolio of diversified public and private market investments on behalf of its 29 British Columbia public sector clients.

With a global outlook, BCI integrates ESG factors into investment decisions and activities that convert savings into productive capital to meet clients’ risk and return requirements over time. Founded in 1999, BCI is a statutory corporation created by the Public Sector Pension Plans Act. For more information, visit BCI.ca or LinkedIn.

CONTACT

media@bci.ca