June 4, 2025

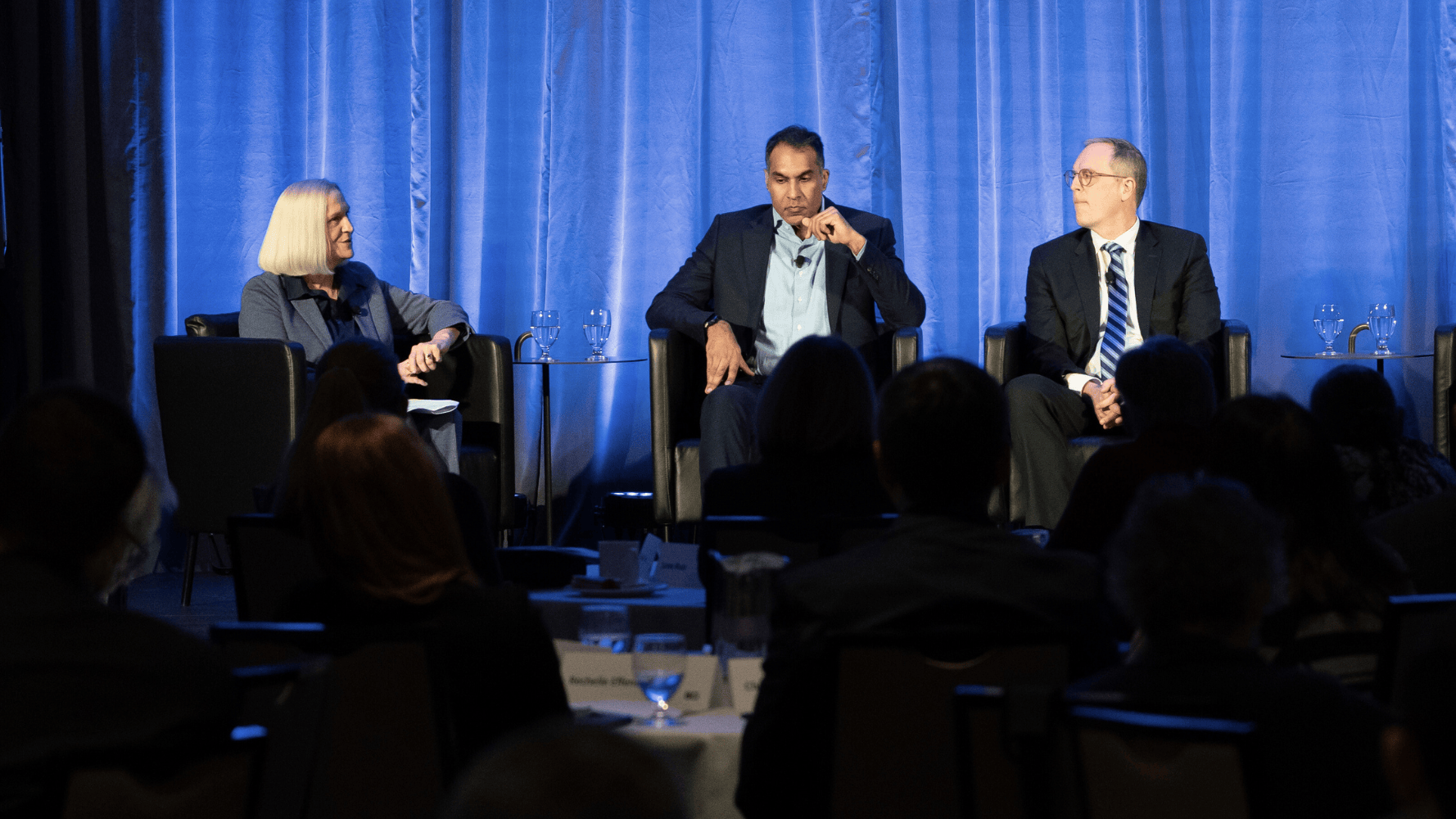

Navigating today’s complex and volatile market environment requires innovative investment strategies. Our recent client education event featured a panel that brought together experts to share their insights and experiences on emerging investment approaches. Highlighting strategies that address the decelerating deal landscape and create opportunities for diversification, risk management, and value creation, the panel included:

- Lynn MacAdam, Vice President, Client Partnerships

- Zaman Velji, Senior Managing Director, Infrastructure & Renewable Resources

- Kenton Freitag, Senior Managing Director, Private Debt

Here are some highlights from the panel discussion:

Q&A with the Panelists

Q: Can you provide an example of a new investment strategy that you’ve recently implemented or are currently working on?

Kenton Freitag: In private debt, one of the most recent strategies we’ve launched is asset-backed financing. This involves lending to a pool of assets, for example, student or car loans, or trade receivables, rather than directly to companies. By increasing the opportunity set, this approach allows us to achieve diversification, augment returns, and lower risk. Instead of being exposed to the risk of a single company, we spread our risk across multiple assets. This diversification helps to mitigate potential losses and enhances the stability of our returns, which is crucial in today’s volatile market environment.

While we are starting this strategy in a modest fashion, with sponsor-backed lending continuing to be the primary driver of our strategy, we anticipate that asset-backed financing will significantly grow within the next two to three years. This growth will allow us to further diversify our investment portfolio, reduce risk, and potentially increase returns by tapping into different asset classes and market opportunities.

Q: What are some innovative areas you’re exploring in the infrastructure sector?

Zaman Velji: We’re participating in opportunities in infrastructure debt, particularly in data centres, which are attractive in this interest rate environment. Investing in debt rather than equity allows us to manage risk more effectively while still participating in the growth of this sector.

As another, more preliminary example, we’re exploring the potential of nuclear energy, which is experiencing a resurgence, and seeking to understand how new technologies, such as small modular reactors, are evolving and the implications they could have for power generation globally.

Q: Can you share an example of an investment idea that didn’t make the cut and why?

Zaman Velji: We take a patient, evolutionary approach with emerging sectors. As an example, for electric vehicle charging infrastructure, we’ve conducted multiple evaluations over several years, tracking how business models are developing and which players are surviving. Several from our first look years ago have disappeared, which validates our cautious approach.

We examine fundamental questions like how money is made—is it through energy sales, retail offerings like at gas stations, or long-term availability-based contracts? We also look at operational requirements like having enough scale to support maintenance teams efficiently. With EV charging, we’ve seen the surviving players all chasing the same growth opportunities, creating intense price competition. As a result, we’ve held back despite the tremendous growth potential in the sector. That said, I imagine it’s just a matter of time before we see EV charging infrastructure mature to fit our risk profile, but we’re not quite there yet.

Q: What are you most proud of for your teams over the past year?

Kenton Freitag: Growing the portfolio while keeping it safe and maintaining spreads has been a significant achievement for our team. Over the past year, we have faced numerous challenges in the market, including increased volatility and economic uncertainties. Despite these obstacles, we have successfully expanded our portfolio by identifying and capitalizing on new opportunities, while ensuring that we keep risk low. This has allowed us to achieve consistent returns for our clients and uphold the integrity of our investments in navigating these complex market conditions.

Zaman Velji: I’m most proud of how we’ve maintained our culture while expanding in size, in breadth, in strategy. With team members in London, Mumbai, Vancouver, and Victoria, keeping a cohesive identity and approach is a source of strength. Despite the distance and time zones, we’ve stayed true to our foundational values—putting clients first, operating with transparency, and maintaining absolute integrity in all we do. These values aren’t just words on a wall; they guide our daily decisions across every office. In a world pulling people in many different directions, preserving this unified culture while growing our footprint has been our most meaningful achievement. That shared DNA makes us stronger as investors and as partners to the communities where our infrastructure assets operate.