Utilities

We invest in utilities providing essential services such as water, electricity, gas, and wastewater treatment services.

Energy

We invest in energy assets including pipeline transmission, distribution, and storage.

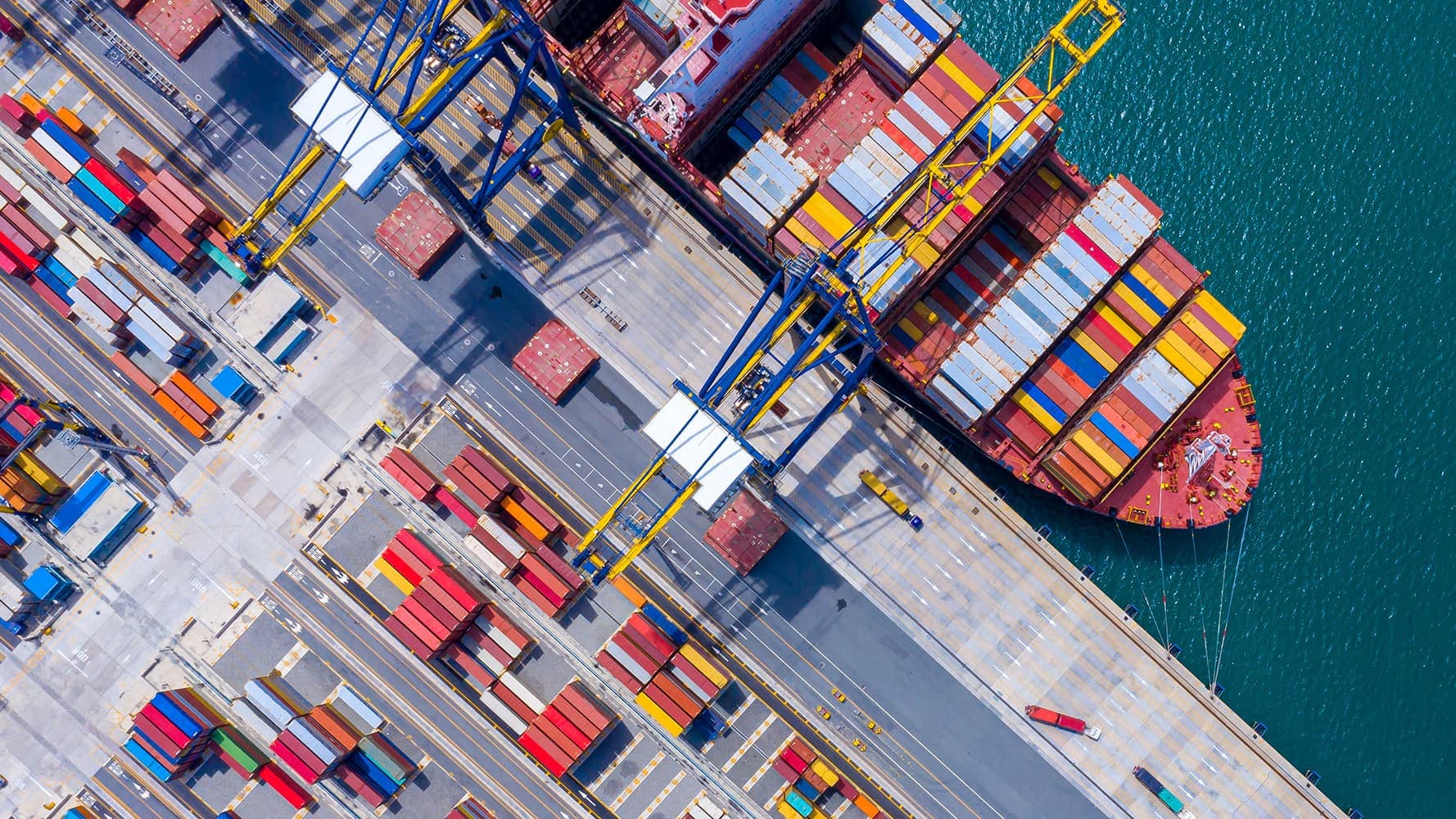

Transportation

We invest in roads, railways, airports, and port terminals.

Digital Infrastructure

We invest in telecommunication towers, data centers, and fiber networks.

Renewable Resources

We invest in timberlands, agribusiness, hydroelectricity, solar, wind, and renewable energy and storage.

$

0

B

ASSETS UNDER

MANAGEMENT

0

%

PERCENTAGE OF AUM IN DIRECT INVESTMENTS2

0

%

5-YEAR RETURN

Investment Team

Our teams in Victoria, B.C. and London, U.K., consist of highly experienced investment professionals. We are performance-focused, and our commitment to accountability and integrity drive our investment decisions.