Prudent asset allocation and stringent liquidity management enabled BCI to perform well amidst ongoing market volatility.

As undercurrents roiled the global economy and capital markets in fiscal 2024, our BCI investment professionals again demonstrated their know-how and resolve by delivering positive returns across most asset classes. The strong showing was due in large part to our teams having already modeled this sort of macroeconomic scenario, buttressing our ability to manage downside risks and capitalize on strategic opportunities stemming from market dislocations. The adverse environment experienced over the past several years has further underscored the benefits of building a well-diversified portfolio focused on high-quality assets, while expanding sources of returns with regard to geographies, asset types and strategies — including private debt, a space BCI entered just five years ago.

A combination of prudent asset allocation and stringent liquidity management with regard to client portfolios enabled BCI to perform well amidst ongoing market volatility. Over the course of fiscal 2024, we added around six months to the liquidity coverage ratio, ending the year with approximately 19 months and still growing. Those robust reserves and sizeable stores of ‘dry powder’ further attest to our effective strategy and risk management frameworks.

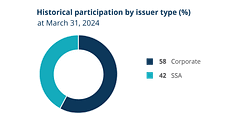

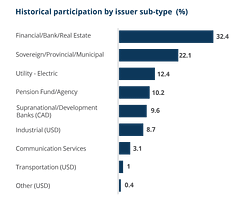

Several noteworthy strategic initiatives, including the evolution of our Funding Program and the addition of unsecured debt, continue to be fundamental to strengthening BCI’s liquidity position. This past year saw the issuance of our inaugural debt offering — which was oversubscribed and, accordingly, re-opened just three months later — achieving a total raise of $2.25 billion. The program also received the highest possible long-term credit ratings from leading global agencies: Moody’s (Aaa), S&P (AAA), and DBRS Morningstar (AAA). Those stellar ratings speak to our exceptional investment and operational capabilities.

As regards debt, we have increased our private debt holdings from zero in 2019 to more than $15 billion. The strategy is performing well, and we have experienced no defaults in our internal portfolios. All credit to the team. The rapid growth of this program reflects an economic milieu that has created a challenging environment for borrowers — and interesting opportunities to address the alternative credit needs of non-sponsor, middle-market companies. So, in another first for BCI, we announced an anchor investment in a new venture between Centerbridge Partners and Wells Fargo that focuses on direct lending to North American mid-market companies. It stands to reason that infrastructure debt was also an important focus area for BCI this year as we sought to offer compelling risk-adjusted returns with lower volatility and high-yielding cash flow. This strategy has been in development since 2020, and we expanded our capital deployment in this space over the past year.

PERFORMANCE HIGHLIGHTS

Performance-wise, BCI found itself with a tough act to follow in the wake of the back-to-back, record-breaking value-add results we achieved in fiscal years 2022 and 2023. This year, we returned 7.5 per cent for our combined pension plan clients, compared to the benchmark result of 11.6 per cent. Nevertheless, we outperformed our benchmarks for the five-, 10-, 15- and 20-year periods. Crucially, we also exceeded the actuarial required rate of return our pension clients need to meet their future obligations over these long-term periods, enabling them to remain in surplus positions.

Closer scrutiny of our relative one-year performance confirms that we outperformed benchmarks for all asset classes except real estate equity and private equity, both of which faced difficult market environments. I wish to note as well that, current challenges notwithstanding, we remain confident in our rebalanced real estate portfolio, which mainly comprises warehouses, data centres, and multi-family housing. Over the past eight years, we have reduced our office weighting by nearly half to 19.1 per cent, holding mostly ‘Class A’ buildings with high occupancy rates. With respect to private equity, we should bear in mind that this asset class has been a star performer and was a major contributor to those record value-add results posted for the 2022 and 2023 fiscal years. However, macroeconomic factors impacting private equity markets have slowed deal flow dramatically over the past year and caused valuations to decline. Additionally, private equity is paired with an internal benchmark holding a public equity index which saw explosive growth driven by the so-called ‘Magnificent Seven1’ tech stocks that collectively make up more than 25 per cent of the S&P 500 index. Suffice to say that, given the extenuating circumstances, we anticipated this year’s underperformance by BCI’s private equity holdings.

ESG LEADERSHIP

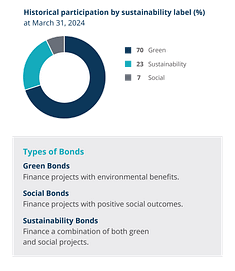

BCI remains firm in its commitment to manage risk and achieve long-term returns on behalf of our clients. We do this by using environmental, social, and governance (ESG) considerations as an integral part of our investment process. Two major ESG-related milestones were reached in fiscal 2024: surpassing the expected 30 per cent reduction in our public equities weighted average carbon intensity2 (WACI); and exceeding the expected $5-billion cumulative participation in sustainable bonds.

Those milestones were achieved ahead of schedule, and I am proud of our team’s ongoing work to support the global goal of net zero and align our portfolio to a low-carbon future.

CLIENTS FIRST

Our organization continues to evolve along with the needs of our clients and their beneficiaries. Accordingly, our focus on innovation must extend beyond technology into all facets of BCI’s overarching operations, culture and values. Nevertheless, I wish to remind stakeholders that there is one constant: BCI’s tried-and-true corporate values, led by ‘Clients First’, remain the driving force behind our strategic planning and decision-making. BCI regularly conducts comprehensive client satisfaction surveys, and I am pleased to report that we attained an overall satisfaction score of 92 per cent in the 2023 calendar year assessment, up six per cent from 2022. Of course our commitment to client satisfaction is by no means limited to investment performance. Rather it’s a measure of our clients’ overall confidence and trust. So I should note that clients also expressed a high degree of approval in how we have supported them through protracted economic and market upheavals, and broader concerns stemming from ongoing geopolitical tensions.

TALENT MANAGEMENT AND DEVELOPMENT

Employee engagement and retention remain top priorities as we return to a more office-centred workplace model, and reinforce our focus on our shared values and collective culture. Teams now spend four days a week in the office to facilitate better communication, mentoring and collaboration. At the same time, we continue to advance our equity, diversity and inclusion (EDI) strategy and roll out our EDI action plan. This year we have provided employee diversity metrics for gender, race and ethnicity in our report, to underscore our commitment to advancing diversity within BCI and the investment industry at large, in alignment with the International Financial Reporting (IFRS) standards.

We also continue to be actively engaged in our campus recruitment program, aimed at forging lasting connections with post-secondary institutions and building a strong pipeline of diverse up-and-coming talent. New this past year is an Indigenous Empowerment Award Scholarship Program, established in partnership with Vancouver Island University. This program supports the development of young Indigenous investment professionals, two of whom were awarded scholarships this year.

ARTIFICIAL INTELLIGENCE: A POTENTIAL GAME CHANGER

I count myself among the growing legions of people who view artificial intelligence (AI) as arguably the most important technological development of our time, and a true game changer for those of us in the investment business — even as we grapple with the risks and benefits this emerging technology might pose. Across BCI, we are actively exploring the potential of various AI applications to improve the way we do things, evaluating tools that hold the promise for helping to drive innovation, streamline processes, boost productivity and unlock the potential for even greater value-add for clients. Furthermore, AI can provide opportunities to redirect precious human resources, freeing team members from monotonous tasks to take on more interesting challenges. Properly handled, I believe there is potential for everyone to emerge as a winner from AI.

COMPLIANCE MONITORING

On a related front, BCI has also launched a new automated compliance system for employee preclearance and disclosures, an imperative for organizations such as ours. Replacing manual processes for preclearing employee trades and monitoring employee compliance is crucial to ensuring we adhere to regulatory guidelines and execute these processes efficiently.

BUSINESS PLAN TRANSITION

This past fiscal year-end saw the completion of BCI’s three-year business plan. Accordingly, in collaboration with the Board of Directors, management spent time this year developing a new business plan to take effect in fiscal 2025. This new plan focuses on three underlying strategic ambitions: Driving Sustainable Growth, Accelerating Innovation, and Operating on a Global Scale.

OPERATING ON A GLOBAL SCALE

We are already well on the way to realizing that latter ambition: our New York and London offices have proven successful in numerous respects, facilitating the hiring and retention of world-class talent and bringing a global perspective that augments BCI’s access to investment opportunities and risk management. I should also note that our presence in Mumbai, India, has proven instrumental in opening doors for BCI on the subcontinent and in neighbouring ASEAN markets. Establishing offices abroad is not without logistical and cultural challenges. However, we are confident that any obstacles we encounter can be successfully overcome by drawing on BCI’s trademark ingenuity and teamwork.

MORE TWISTS AND TURNS AHEAD FOR GLOBAL MARKETS

Looking ahead, we anticipate ongoing near-term market volatility, which means our investment strategy & risk team will be kept busy modeling various scenarios and pathways. Given that inflation and interest rates remain high in certain key economies, we continue to closely monitor recession indicators as well as several worrisome geopolitical conflicts that pose a threat to global stability through the risk of contagion.

Be that as it may, we remain focused on clients’ long- term goals and regard the near-term volatility as both a challenge and an opportunity to support value creation in our investments. It’s all about continuing to find innovative solutions to deliver risk-adjusted returns for our clients’ portfolios, no matter the market conditions.

As I have previously observed, relationships are at the heart of what we do. Active investing is anchored in the quality and strength of the relationships between partners. BCI’s global growth brings us closer to where many of our partners and investment opportunities are to be found. At the same time, stakeholders can rest assured that we will remain grounded in our underlying purpose: providing world-class investment management services to British Columbia’s public sector.

On that note, I wish to acknowledge and thank our clients for the ongoing trust they place in us as their asset manager; the BCI Board of Directors for their diligence and engagement in our governance; as well as my colleagues in senior management and the entire BCI team for their unstinting efforts and commitment to the realization of our goals.

Gordon F. Fyfe

Chief Executive Officer/Chief Investment Officer

1 The Magnificent Seven consists of U.S. technology stocks: Alphabet (GOOGL), Amazon.com (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).

2 Calculated using the weighted average carbon intensity methodology.