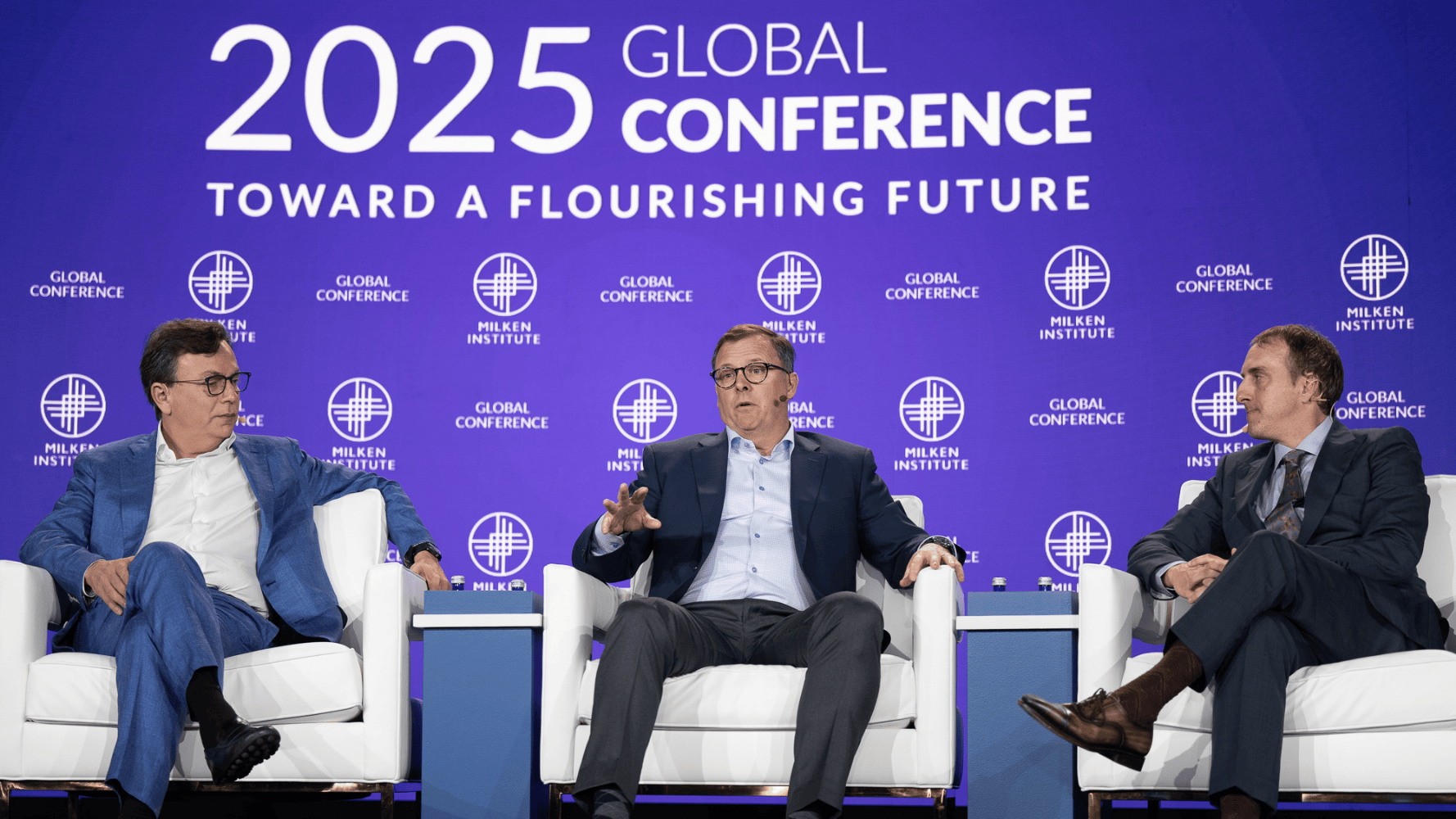

Jim Pittman and Industry Leaders Discuss the Path Forward for the Private Equity Sector at the 2025 Milken Conference

The Milken Institute Global Conference is renowned for convening experts and innovators shaping the future of finance, business, technology, health, industry, and society. At this year’s event, the panel “Private Equity Transformed: Access, Strategy, and Innovation” brought together leading voices in private equity, including Jim Pittman, EVP, Global Head of Private Equity at BCI, alongside executives from KKR, General Atlantic, and Thoma Bravo. The discussion focused on evolving trends in deal flow, performance, value creation, talent, and sector appetite.

Trends in Private Equity Investment Exits

A central theme of the panel discussion was the shifting dynamics in private equity exits. BCI’s Jim Pittman highlighted that while 2021 saw a record US$1.2 trillion in deals sold, 2024’s figure plummeted to just US$250 billion, pointing to a confluence of factors including inflation, geopolitical risk, and supply chain disruptions. All panelists agreed: “Nothing kills M&A activity more than uncertainty.”

After several years marked by sluggish distributions and a backlog of aging portfolio companies, 2025 is showing signs of renewed activity. Panelists expressed cautious optimism that, as volatility decreases, the IPO market could see significant improvement. Strategic corporate buyers are also showing early signs of renewed M&A interest. This optimism is supported by industry data, with global exit values rising 34% year-over-year and exit counts up 22%, according to a recent Bain report, signaling that pent-up demand is beginning to translate into real deal flow.

Pittman’s commentary reflected a broader industry push to unlock liquidity for limited partners (LPs) after several lean years. He pointed to the growing relevance of the secondary market and continuation funds as alternative paths for exits. GPs are also looking at other ways of unlocking liquidity through “componentized sales” – selling off portions of their holdings to unlock liquidity. One GP emphasized the importance of considering multiple exit strategies: “Less than 20 per cent of [their] realisations now come from IPOs. Over 50 per cent come from some type of strategic sale, such as large corporate buyers.”

The panel also highlighted a healthy pipeline of investments at attractive valuations. “I’m super excited about the buyer’s market. We’re buying things 50% off or more-pricing we haven’t seen since the global financial crisis,” remarked one panelist.

Pittman reinforced that BCI is actively seeking opportunities in sectors with strong fundamentals and operational value creation potential. He noted that BCI remains active, having sold three companies and acquired three others in the past eight months. In the past year, BCI Private Equity unlocked C$2.8 billion of capital through asset sales, successfully generating liquidity and securing strong realized returns as a result of the program’s focus on active portfolio management. The sale of BCI’s majority stake in Hayfin Capital and the announced sale of our investment in Ziply Fiber are two recent examples, in addition to secondary fund sales.

Rethinking Private Equity Returns and Value Creation

The panel also addressed how to best model and interpret expected returns in today’s environment. Pittman cautioned against relying solely on historical benchmarks of internal rates of return (IRRs), noting that high returns in recent years were often fuelled by leverage and favourable market cycles. “If we secured 25 per cent returns in the past, we should be able to get that in the future – but the reality is changing,” Pittman explained. “The longer assets sit, the lower those IRRs go – unless you have great value creation activities or other triggers you can pull.”

As the industry sees IRR dropping below historical averages, Pittman and other panellists stressed the need for more nuanced performance metrics, especially as hold periods lengthen and exit routes become more complex. The dispersion of returns in private equity is significant: top-quartile GPs vastly outperform the median, often by leveraging in-house value-creation talent. Rather than focusing solely on headline performance, a more detailed approach-disclosing the sources of returns, such as leverage, growth, or multiple arbitrage – is helping LPs understand which levers are driving GP performance.

The group also discussed AI as a value creation tool, particularly for unlocking productivity savings and revenue enhancement at portfolio companies. Most benefits from AI were seen in enhanced productivity and operating efficiencies, though some companies are using it to drive revenue growth. As one panelist put it, “the playbooks are repeatable.”

Recognizing the value AI will play in future private equity investments and business processes at large, BCI has already implemented AI as part of its value creation toolkit – to drive innovation, streamline processes, and unlock new analytical capabilities. BCI Private Equity’s Venture and Growth team is also actively investing in and sourcing new opportunities to partner with companies that could benefit from AI implementation, or are in AI-adjacent industries, such as FinTech, cybersecurity, development platforms, logistics, insurance or quantum computing.

Talent: A differentiating factor for Private Equity Performance

Talent emerged as a critical driver of private equity performance, especially as returns increasingly depend on value creation. Panelists discussed the growing complexity and importance of these activities, advocating for a shift from transactional workforce management to long-term, in-house talent development. Investing in human capital and operational expertise delivers significant benefits.

Many private equity firms are generating value through operational improvement playbooks that in-house value creation teams can consistently apply across investments. As one panelist said: “If you have best-in-class [value creation] talent to bring to the table, you can have a reliable source of alpha. It’s a playbook that you can execute on.”

The panel also advocated for transparent alignment structures and broad-based ownership to drive behaviours and accelerate growth. When all stakeholders share goals and incentives, and you have very transparent KPIs, you’re likely to see a higher rate of change, and that often leads to higher rate of growth.

Talent is always top of mind at BCI. BCI Private Equity recently welcomed several investment professionals – growing both in-house value creation capabilities and sector expertise within its high-performing team.

Sector and Sourcing Focus: Appetite and Opportunity

Industrials remain a key sector for some GPs, who emphasized “local-for-local” supply chains as a unique opportunity amid shifting global trade. Pittman noted that industrial assets make up about 18 per cent of BCI Private Equity’s portfolio, with a large portion held as co-investments. He acknowledged the unique nature of industrial investments, describing them as “capex heavy” and requiring proactive M&A and trend anticipation. Other panelists preferred asset-light businesses in today’s unpredictable market.

Private equity deal sourcing has also shifted. The number of companies private equity teams meet with has significantly increased – to nearly 10x the number of firms they met with a decade ago, and meeting companies early is critical to not missing out on opportunities. Panelists also acknowledged a shift in where opportunities are currently being sourced, with several mentioning that most of the recent opportunities they have sourced are located outside of the U.S., whereas just a few years ago the majority were sourced within it. Europe is a key geography, with many opportunities emerging from family-owned private businesses. These companies need a partner to help them be best in class, and they need a partner to help them through succession, digitization and automation trends.

BCI Private Equity has already recognized the opportunity in Europe, and proactively expanded to include a new London-based team.

Key Takeaways

The insights from Pittman and fellow panelists underscore several key trends for global private equity investors:

- The exit window is reopening, with IPOs and strategic sales gaining momentum as market volatility eases.

- IRR remains a key metric, but is under more pressure due to longer hold periods. This is prompting a shift toward more holistic performance metrics and longer-term value creation activities to retain solid returns.

- Talent is a core driver of private equity success, with alignment and engagement critical to outperformance.

- Appetite for capex-heavy investments is mixed, though attractive valuations are presenting rare buying opportunities.

- A growing proportion of investment opportunities are now being sourced outside of the U.S.

The future of private equity, as seen through the panelists’ lens, will be defined by adaptability, operational discipline, and a broader perspective around creating portfolio liquidity. As Jim Pittman put it: “The art of the deal is both the buy and the sell”.

Watch a recording of the panel discussion here:

Selecting the right GP private equity partner remains crucial to LPs, such as BCI Private Equity. The dispersion of returns across private equity funds can be significant, and selecting the right GPs to invest with can make a significant difference when it comes to investment outcomes.

“In North America alone, there are 19,000 private equity funds. There are less than 14,000 McDonalds.”

*Figure based on Prequin data